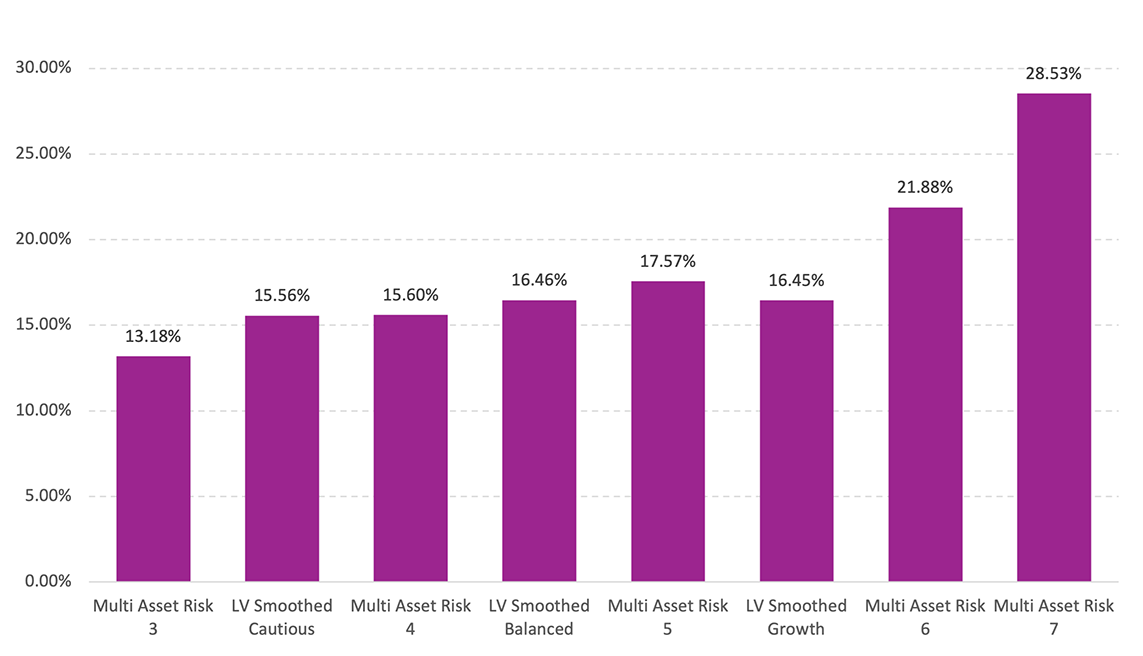

Following a strong end to 2020 which continued into the first part of 2021, we saw most equity markets around the world retreat a little in the last few days of January, ending the month in marginally negative territory. Emerging market risk assets stood out in portfolios as they continued an upward trend: outperforming most developed markets by around 4% over the month which boosted the higher risk portfolios with their higher exposures to these more volatile areas.

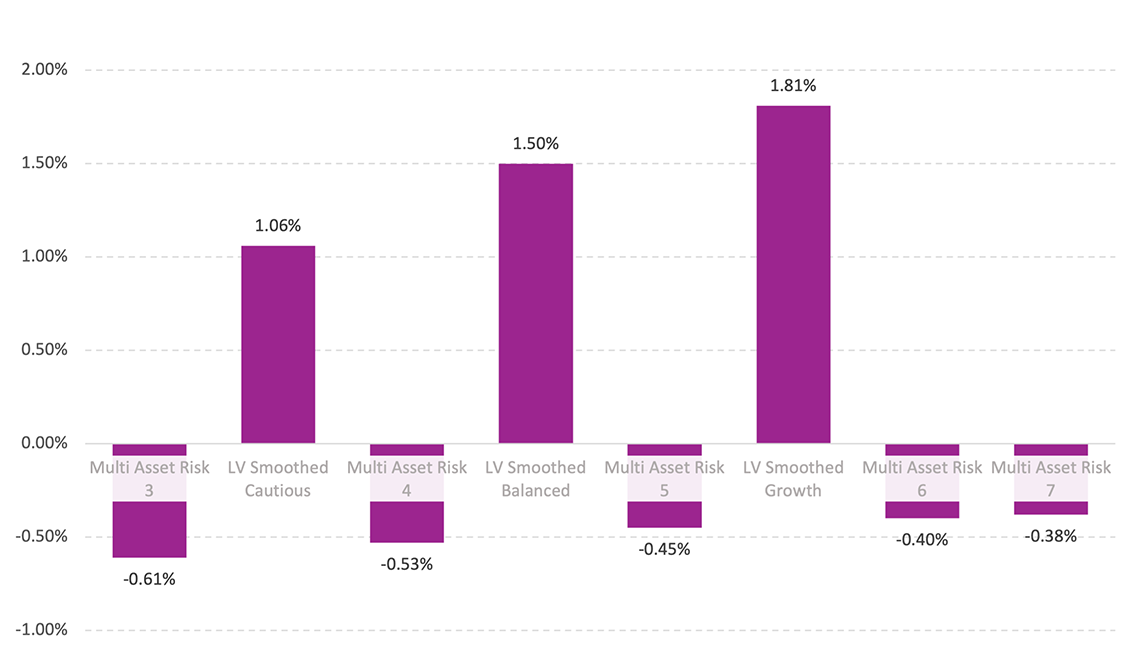

‘Smoothed’ Fund returns lag behind the multi-asset portfolios over the longer-term, but they demonstrated their ability to smooth-out temporary volatility such as seen in Jan 2021.

Taking a step back and looking at the wider environment, we’ve continued to see the roll out of vaccines, however the rate and success of this has opened up wide divergences between countries. Delays in vaccination delivery could push back any rebound in domestic markets across the European block.

Economic stimulus hopes were given a new lease of life with the surprise Democratic sweep following the run-off elections in Georgia, which gave Biden the Blue Wave win, and lifted expectations of government spending in the US.

Additional fiscal stimulus hopes have helped markets overlook economic and social restrictions. The market falls at the end of January could have been a technically driven sell-off: something that should not be too concerning for long-term investors at this point in time.

Markets might be very tightly priced now, and this could lead to spikes in volatility if the trajectory is suddenly changed by unexpected economic data. Maintaining a good level of diversification at this time, as we do in the portfolios is a key imperative.